Canadian home sales edge up in August

Ottawa, ON, September 15, 2017 – According to statistics released today by The Canadian Real Estate Association (CREA), national home sales posted a small gain in August 2017.

Highlights:

- National home sales rose 1.3% from July to August.

- Actual (not seasonally adjusted) activity stood 9.9% below last August’s level.

- The number of newly listed homes fell a further 3.9% from July to August.

- The MLS® Home Price Index (HPI) was up 11.2% year-over-year (y-o-y) in August 2017.

- The national average sale price climbed by 3.6% y-o-y in August.

The number of homes sold via Canadian MLS® Systems edged up by 1.3% in August 2017. The small gain breaks a string of four straight declines, but still leaves activity 13.8% below the record set in March.

There was a roughly even split between the number of local markets where sales posted a monthly increase and those where activity declined. The monthly rebound in Greater Toronto Area (GTA) (14.3% month-over-month) sales fueled the national increase. For Canada net of the GTA, sales activity was flat. While it was the first monthly increase in activity since Ontario’s Fair Housing Policy was announced, GTA sales activity remained well down compared to the peak reached in March (-36%) and year-ago levels (-32%).

Actual (not seasonally adjusted) activity was down 9.9% on a y-o-y basis in August 2017. Sales were down from year-ago levels in about 60% of all local markets, led by the GTA and nearby housing markets.

“Experience shows that home buyers watch mortgage rates carefully and that recent interest rate increases will prompt some to make an offer before rates move higher, while moving others to the sidelines,” said CREA President Andrew Peck. “All real estate is local, and REALTORS® remain your best source for information about sales and listings where you live or might like to.”

“Time will tell whether the monthly rise in August sales activity marks the beginning of a rebound, particularly in the Greater Golden Horseshoe region and other higher-priced urban centres,” said Gregory Klump, CREA’s Chief Economist. “The picture will become clearer once mortgages that were pre-approved prior to recent interest rate hikes expire.”

The number of newly listed homes slid a further 3.9% in August, marking a third consecutive monthly decline. The national result largely reflects a reduction in newly listed homes in the GTA, Hamilton-Burlington, London-St. Thomas and Kitchener-Waterloo, as well as the Fraser Valley.

With sales up and new listings down in August, the national sales-to-new listings ratio rose to 57% compared to 54.1% in July. A national sales-to-new listings ratio of between 40% and 60% is generally consistent with balanced national housing market, with readings below and above this range indicating buyers’ and sellers’ markets respectively.

That said, the rule of thumb varies according to local market level. Considering the degree and duration to which current market balance in each local market is above or below its long-term average is a more sophisticated way of gauging whether local conditions favour buyers or sellers. (Market balance measures that are within one standard deviation of the long-term average are generally consistent with balanced market conditions).

Based on a comparison of the sales-to-new listings ratio with its long-term average, some 70% of all local markets were in balanced market territory in August 2017, up from 63% the previous month. A decline in new listings has firmed market balance in a number of Greater Golden Horseshoe housing markets where it had recently begun tilting toward buyers’ market territory.

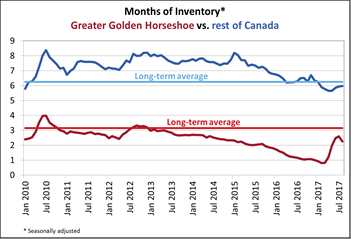

The number of months of inventory is another important measure of the balance between housing supply and demand. It represents how long it would take to completely liquidate current inventories at the current rate of sales activity.

There were 5 months of inventory on a national basis at the end of August 2017, down from 5.1 in July and slightly below the long-term average of 5.2 months.

At 2.3 months of inventory, the Greater Golden Horseshoe region is up sharply from the all-time low of 0.8 months reached in February and March just before the Ontario government announced housing policy changes in April. However, it remains well below the long-term average of 3.1 months. (Chart A)

At 2.3 months of inventory, the Greater Golden Horseshoe region is up sharply from the all-time low of 0.8 months reached in February and March just before the Ontario government announced housing policy changes in April. However, it remains well below the long-term average of 3.1 months. (Chart A)

The Aggregate Composite MLS® HPI rose by 11.2% y-o-y in August 2017, representing a further deceleration in y-o-y gains since April. The deceleration in price gains largely reflects softening price trends in Greater Golden Horseshoe housing markets tracked by the index. (Chart B)

Price gains diminished in all benchmark categories, led by two-storey single family homes. Apartment units posted the largest y-o-y gains in August (+19.5%), followed by townhouse/row units (+14.4%), two-storey single family homes (+8.3%), and one-storey single family homes (+8.1%).

While benchmark home prices were up from year-ago levels in 12 of 13 housing markets tracked by the MLS® HPI, price trends continued to vary widely by region.

After having dipped in the second half of last year, benchmark home prices in the Lower Mainland of British Columbia have recovered and are now at new highs (Greater Vancouver: +9.4% y-o-y; Fraser Valley: +14.8% y-o-y).

Benchmark home price increases have slowed to about 16% on a y-o-y basis in Victoria, and are still running at about 20% elsewhere on Vancouver Island.

Price gains slowed further on a y-o-y basis in Greater Toronto, Oakville-Milton and Guelph; however, prices in those markets remain well above year-ago levels (Greater Toronto: +14.3% y-o-y; Oakville-Milton: +11.4% y-o-y; Guelph: +19.5% y-o-y).

Calgary benchmark price growth remained in positive territory on a y-o-y basis in August (+0.8%). While Regina home prices popped back above year-ago levels (+5.6% y-o-y), Saskatoon home prices remain down (-0.3% y-o-y). That said, prices of late have been trending higher in both Regina and Saskatoon and if recent trends hold, Saskatoon prices will also turn positive on a y-o-y basis before year-end.

Benchmark home price growth accelerated in Ottawa (+5.9% y-o-y overall, led by a 7% increase in one-storey single family home prices) and was up in Greater Montreal (+4.6% y-o-y overall, led by a 7.1% increase in prices for townhouse/row units). Prices were up 5.1% overall in Greater Moncton, led by a 7.9% y-o-y gain in townhouse/row prices. (Table 1)

The MLS® Home Price Index (MLS® HPI) provides the best way of gauging price trends because average price trends are prone to being strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average price for homes sold in August 2017 was $472,247, up 3.6% from where it stood one year earlier. The national average price is heavily skewed by sales in Greater Vancouver and Greater Toronto, two of Canada’s most active and expensive markets. Excluding these two markets from calculations trims almost $100,000 from the national average price ($373,859).

– 30 –

PLEASE NOTE: The information contained in this news release combines both major market and national sales information from MLS® Systems from the previous month.

CREA cautions that average price information can be useful in establishing trends over time, but does not indicate actual prices in centres comprised of widely divergent neighbourhoods or account for price differential between geographic areas. Statistical information contained in this report includes all housing types.

MLS® Systems are co-operative marketing systems used only by Canada’s real estate Boards to ensure maximum exposure of properties listed for sale.

The Canadian Real Estate Association (CREA) is one of Canada’s largest single-industry trade associations, representing more than 120,000 REALTORS® working through some 90 real estate Boards and Associations.

Further information can be found at http://crea.ca/statistics.

For more information, please contact:

Pierre Leduc, Media Relations

The Canadian Real Estate Association

Tel.: 613-237-7111 or 613-884-1460

Leave a Reply

Want to join the discussion?Feel free to contribute!